Effective 5 November, we are making some changes to home loan terms and conditions, fees and default interest.

We’re making some changes to

Home loan terms and conditions, fees and default interest

You can find an overview of the changes below. These changes will apply to your home loan from 5 November 2024.

Changes to Home Loan terms and conditions

We’re introducing a minimum payment amount of $1,000 for staff assisted payments made in branch or over the phone to your home loan, when you choose to repay some of your fixed rate home loan early. This minimum payment amount does not apply to additional payments you make online or in the TSB app. This minimum amount can change from time to time. We will publish any future changes to it on our website.

You can still make extra payments on each fixed rate home loan online, on mobile banking, in branch, or over the phone up to a total of $10,000 per calendar year with no early repayment fee. If you pay more than this or break a fixed term early, you may need to pay an early repayment fee.

Changes to default interest

We won’t be charging default interest on home loans. This would normally apply when you don’t make a payment when it’s due on a table loan, or if you go over your limit on a revolving loan. We’ll let you know if this changes in the future.

Changes to how we calculate Early Repayment fees

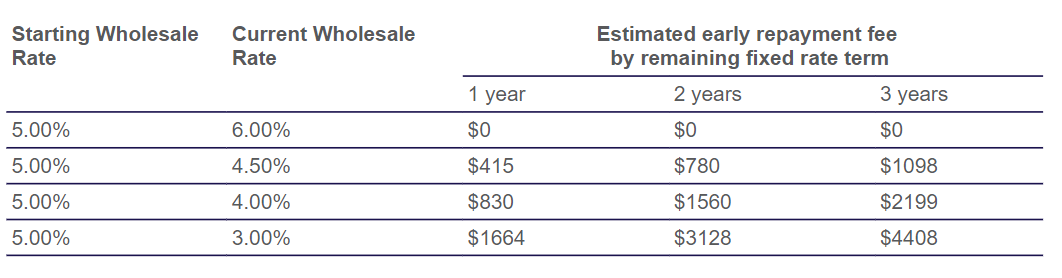

We’re changing the way we calculate our early repayment fees. If you decide to break your fixed rate home loan to switch to a different interest rate1, fully repay the loan early, ask us to restructure your home loan, or make over $10,000 in additional payments over the calendar year for example, an early repayment fee may apply.

The new calculation is based on wholesale interest rates as this provides a more accurate estimate of the likely loss to us (if any), when you break or repay your fixed rate home loan early. It also provides a more consistent calculation method for all our customers.

We’re here to help

You can download our updated Home Loan terms and conditions and Home Loan Fees Information that come into effect 5 November 2024 below. Updated copies will also be available in-branch from 5 November 2024.

Home loan terms and conditions and Home loan fees information.

If you have any questions, you can call us on 0800 872 226 Monday to Friday 8am – 6pm, or weekends 9am – 5pm. We’ll be happy to help.

Early repayment fee FAQs

Important information

1If you break your fixed rate early to refix to a new interest rate, this is treated as a full repayment as we’ll give you a new home loan with the changes you’ve asked for.