Your fixed rate home loan

When you choose a fixed rate home loan, your interest is fixed from the start and stays the same for the term you've chosen. This option makes budgeting easier, because your payments will stay the same over the fixed rate term you’ve chosen.

You're also able to make extra payments up to $10,000 per calendar year; however, if you pay more than this or break a fixed term early, you may need to pay an Early Repayment fee. A minimum payment amount may also apply1.

Repaying or breaking your home loan early

If you decide to break your fixed rate home loan early to switch to a different interest rate2, fully repay the loan early, ask us to restructure your home loan, or make over $10,000 in additional payments over the calendar year for example, an Early Repayment fee may be charged.

We calculate whether repaying or breaking your home loan earlier than agreed will result in a loss for us. If it does, we may charge an Early Repayment fee to help recover this loss.

How we calculate the fee

Rather than using the calculation in the Credit Contracts and Consumer Finance Regulations 2004, we use our own mathematical formula. This formula is complex, but it takes into account the following to see if an early repayment fee is to be charged, and if so, how much.

What’s considered

- The amount being repaid early, including any additional repayment allowance remaining.

- The wholesale interest rate3 at the start of your fixed rate term.

- The relevant wholesale interest rate3 at the date of your early repayment, for a period equal to the time remaining in your fixed rate term.

- What your current regular payments are.

- We adjust the wholesale interest rate3 to reflect certain characteristics of your loan.

What we compare

- We calculate the interest charges and your scheduled regular payments that would have been made over the time remaining in the fixed rate term, using the wholesale interest rate3 that applied at the start of your fixed rate term (the first amount) and,

- We calculate the interest charges and your scheduled regular payments due from the date of your early repayment to the end of your fixed rate term, using the wholesale interest rate3 that would apply for the time remaining in your fixed rate term (the second amount).

We adjust both amounts to recognise that we will receive the payment now, instead of over the term of the home loan.

If the first amount is larger than the second amount, we expect that your early repayment will cause a loss to us and an Early Repayment fee will be charged.

The way we calculate the fee can be expressed (in a simplified way) as:

Early repayment fee = Amount you wish to pay * interest rate differential * remaining fixed rate term

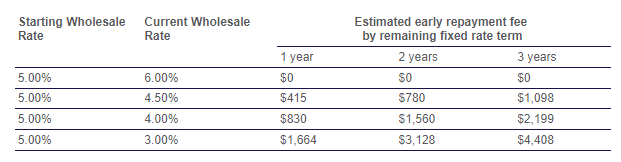

Repayment examples

A home loan to suit you

When it comes to your home loan, we understand your needs are unique to you and your household, and one size doesn't fit all. We’ve got great rates, loan and repayment options, and a home loan calculator to help you work it out.

Important information

1For some methods of payment, we may set a minimum payment amount that you must pay each time you choose to repay some of your loan early. If we do set a minimum payment amount, you can find this on our home loan rates, fees and agreements page.

2 If you break your fixed rate early to refix to a new interest rate, this is treated as a full repayment as we’ll give you a new home loan with the changes you’ve asked for.

3 Wholesale interest rates are wholesale interest swap rates determined using relevant market information. When we determine the applicable rates, we use the most recently available market rate we have on the relevant day.